Stick to Your Core. Compound on What Works.

A few months ago, I made a costly mistake.

Not because of the market — but because of myself.

When new trading regulations were introduced, I convinced myself that my old approach — the one I’d built, refined, and profited from for years — was now obsolete.

In reality, those regulations didn’t stop me from trading my original way.

But I fell for what I call Shiny Object Syndrome.

I switched my system completely, tried to reinvent my trading style overnight — new setups, new rules, new everything.

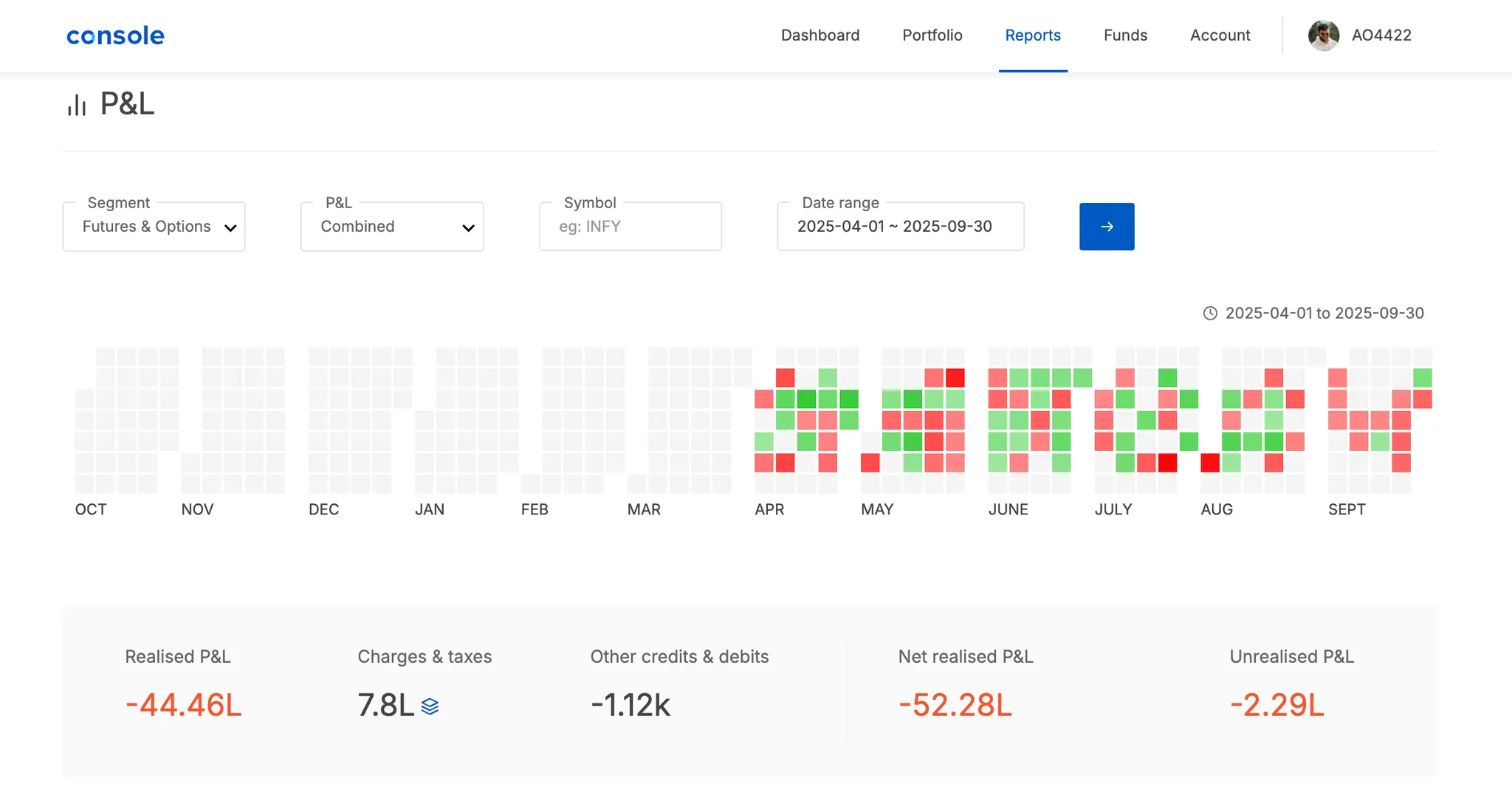

Result? A ₹50 Lakh drawdown.

Then I took a step back.

I realized nothing was wrong with my edge. I was.

I returned to my core — my original framework that had consistently compounded over time.

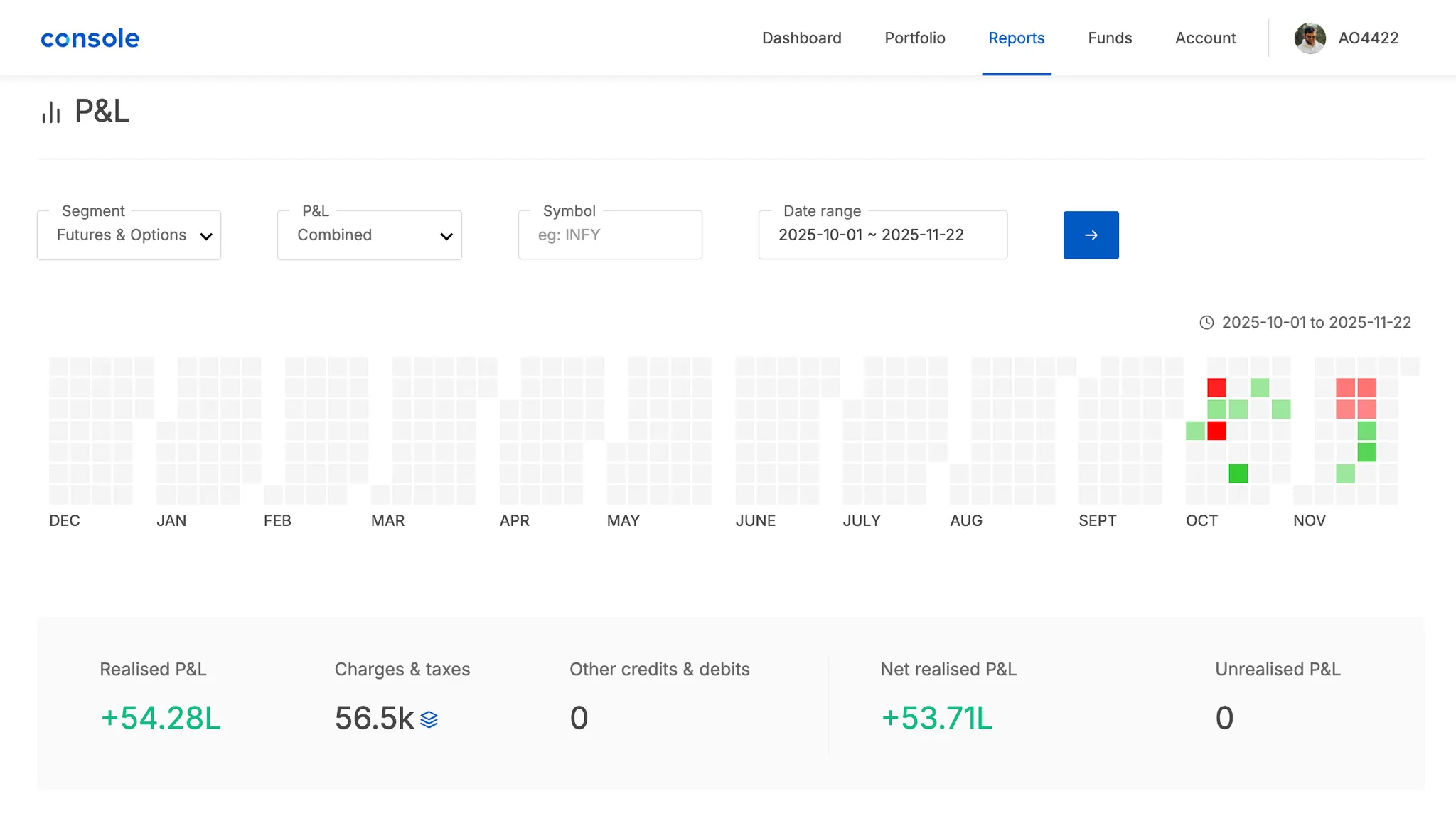

Within two months, I recovered the entire drawdown without taking on excessive risk — just by doing what I know best.

The takeaway?

Trying new things is essential for growth — but not at the cost of abandoning what already works.

Experiment at the edges, not at the core.

Compounding doesn’t come from chasing every new method or trend.

It comes from deepening your competence, not diversifying your confusion.