The Art of Waiting: Why Directional Trading is More About Patience Than Action

There's a common belief that successful trading requires constant action. More screens, more trades, more complexity. When I tell people I sometimes go an entire week without placing a single trade, they look at me like I'm wasting my time. But those empty weeks are exactly what make the full weeks profitable.

I trade directional NIFTY and Bank Nifty futures. No iron condors, no calendar spreads, no complex multi-leg strategies. I identify a direction, take a position, and wait. That's it. And honestly, that "that's it" is the hardest part of the entire job.

What My Actual Day Looks Like

Let me kill the glamorous image of trading right away.

Most of my mornings start with checking overnight global cues. US markets, Asian markets, SGX Nifty, crude oil, dollar index. This takes about 20-30 minutes. Then I pull up NIFTY and Bank Nifty charts, mark the key levels from the previous session, and identify zones where I'd be interested in entering.

And then? Most days, I do nothing.

I sit and watch. I read. I might journal about setups I'm watching but not taking. Three, sometimes four days in a row, the market doesn't give me what I'm looking for. The levels aren't being tested, or the price action at those levels doesn't look convincing, or the broader context (global sentiment, FII data, upcoming events) doesn't support a trade.

During NIFTY expiry weeks, there are times when I'll go Monday through Thursday without a single trade. My watchlist has setups on it, my alerts are set, but nothing triggers. Other traders around me are churning out 10-15 trades a day in options, posting screenshots, sharing P&L updates. And I'm sitting there with a flat portfolio.

That's the reality of directional trading. It's 80% waiting and 20% acting. The waiting isn't the boring part you endure before the fun begins. The waiting IS the edge.

The Emotional Weight of MTM Swings

Here's something options sellers don't fully appreciate: when you trade directional futures, every single point of movement hits your P&L directly. There's no theta cushion, no volatility decay softening the blow. It's raw, unfiltered exposure.

I've had trades where I'm up 2 lakhs in the morning, down 1.5 lakhs by lunch, and back up 3 lakhs by close. That's a 4.5 lakh swing in a single day on a position I haven't touched. The market didn't care about my analysis. It just did its thing, and I had to sit through all of it.

The psychological load of watching your mark-to-market fluctuate by lakhs is something you can't prepare for theoretically. The first time you see -2,00,000 on your screen on a position you believe in, every instinct screams at you to close it. Your hands literally hover over the exit button. Your heart rate goes up. You start rationalizing why the trade is wrong even though nothing about your original thesis has changed.

Learning to sit through that, to watch unrealized losses swell and not panic, that's the real skill. It's not chart reading or technical analysis. It's emotional regulation under financial pressure. And it only comes from experience and, honestly, from taking enough painful losses to understand what normal volatility feels like versus a genuine thesis breakdown.

How Directional Differs From Options Trading

I've traded both, and they're fundamentally different games despite operating in the same market.

Options trading, especially selling, is about managing multiple variables simultaneously. Delta, theta, vega, gamma, your overall Greeks exposure, the impact of IV crush or expansion, assignment risk near expiry. It's intellectually stimulating. There's always something to adjust, hedge, or roll. You're constantly busy.

Directional futures trading strips all of that away. You have one variable: price. Did it go in your direction or didn't it? The simplicity is almost deceptive because it makes people think it's easier. It's not. It's just different.

With options, you can be wrong on direction and still make money through time decay. With futures, there's no forgiveness. You're either right or you're paying for being wrong, point by point. That binary nature forces you to be extremely selective about when you step in.

The Quality Over Quantity Math

Let me share some numbers that might surprise you.

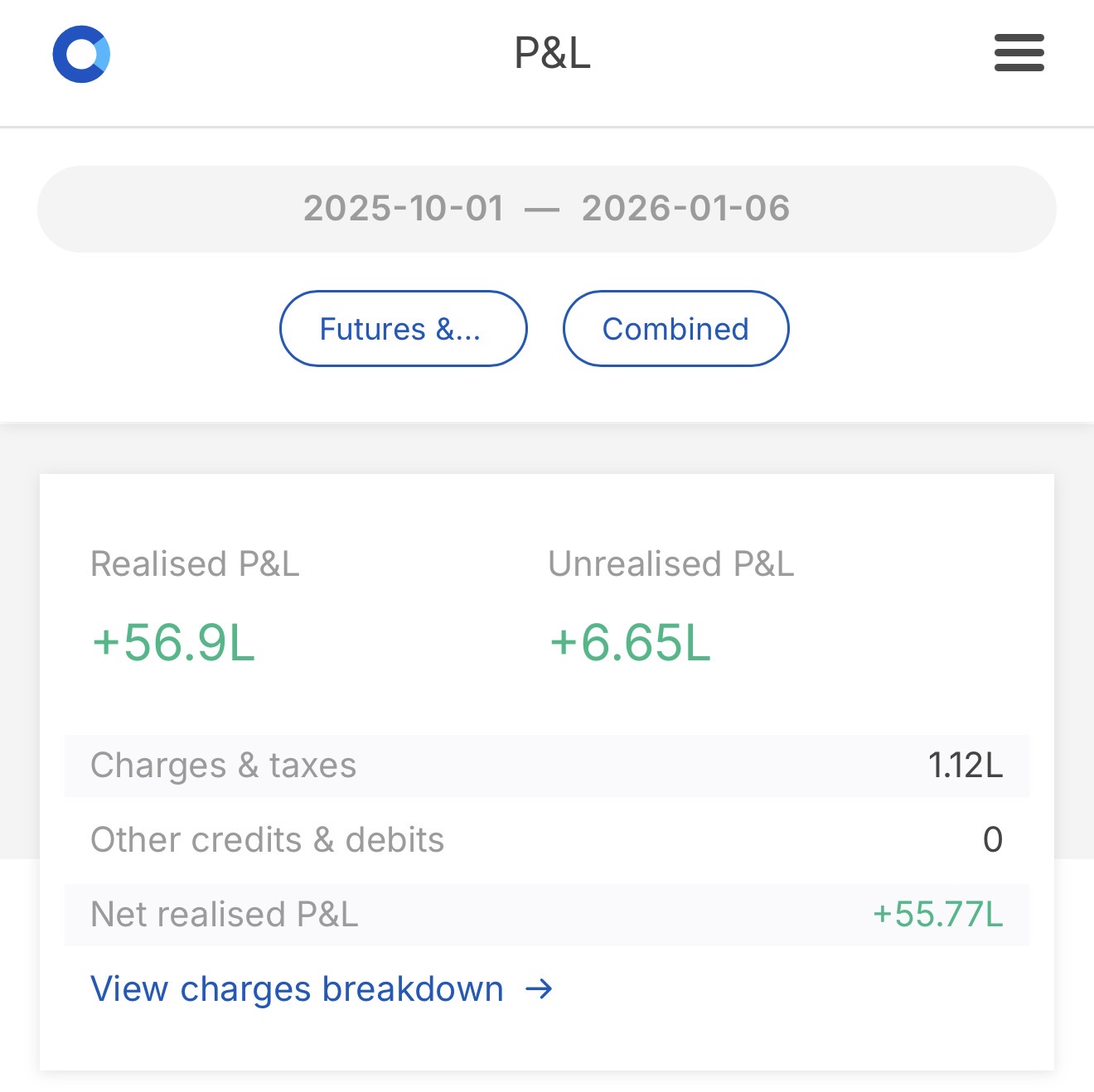

Look at the net realized P&L of +55.77L. Now look at the charges breakdown. This is where directional trading's cost advantage becomes obvious.

Every trade you take costs money: brokerage, STT, exchange charges, GST, SEBI turnover fees, stamp duty. For futures, these charges are significantly lower per rupee of exposure compared to options. But more importantly, fewer trades mean fewer instances of paying these charges.

Let's do rough math. A trader who takes 15 trades a day in options, paying roughly Rs 100-150 in total charges per trade (across all the fees), spends Rs 1,500-2,250 daily. Over 22 trading days, that's Rs 33,000-49,500 per month just in charges. Over a year? Rs 4-6 lakhs gone before you've made or lost a single rupee on your actual positions.

I might take 3-5 trades in a week. My monthly charges are a fraction of that. Over a year, that difference alone can be the gap between a profitable and unprofitable year for many traders.

Fewer trades also mean less slippage. Every market order you place, especially in fast-moving conditions, you're giving up a few points to the spread. Multiply that by hundreds of trades a month and it's a meaningful drag on performance. When you trade selectively, slippage is almost negligible.

The Daily Routine of Doing Less

People expect a directional trader's routine to be exciting. It's not.

Pre-market (8:30-9:00 AM): Review overnight global cues, check SGX Nifty, read any major news. Mark key levels on the daily and 15-minute chart.

Market open (9:15-9:30 AM): Watch the opening 15-minute candle. I almost never trade in the first 15 minutes. The opening is chaotic, spreads are wide, and the real direction often doesn't reveal itself until the initial noise settles.

Mid-morning (9:30 AM-12:00 PM): If my setup triggers, I enter. If not, I watch. Sometimes I'll step away from the screen entirely if nothing's developing. There's no point staring at charts when the market is chopping around in a tight range.

Afternoon (12:00-2:00 PM): This is usually dead time. Low volume, no conviction. I use this time to journal, review old trades, or study charts from other markets.

Final hour (2:00-3:30 PM): If I have a position, I'm actively managing it for close. If I don't, I might look for a late-session setup, but only if the conditions are exceptional. I don't force trades just because the day felt "empty."

Most days, my total active trading time is under 2 hours. The rest is observation, preparation, and deliberately choosing not to act.

The Hardest Lesson

The market rewards patience far more than it rewards activity. Every unnecessary trade you take is a decision that introduces risk, incurs cost, and consumes mental energy. The best traders I've observed, and this took me years to internalize, are the ones who are comfortable with empty days.

Directional trading strips away the complexity of multi-leg strategies and Greek management. What's left is trading in its purest form: identifying direction and having the courage to act on conviction. But the real courage isn't in taking the trade. It's in not taking the twenty trades that came before it.

For those who can master the art of strategic waiting, directional trading offers substantial returns through focused, high-conviction trades rather than frequent market participation. The P&L takes care of itself when you stop trying to force it.